12 Smart Tips for Getting a Small Business Loan My Own Business Institute Learn How To Start a Business

Contents:

Government programs kept many small businesses alive during the pandemic. However, the Paycheck Protection Program and Employee Retention Credit are no longer accepting applications at this time. You can combat these surging rates by raising product prices for your customers, so there’s no need to “worry” about the increased rates from the supplier — don’t absorb rising costs. These financing trends may impact your small business this year, including lender restrictions, increasing interest rates, and supply chain issues.

However, as simple and pleasing as it sounds, you need to tread wisely and keep everything formal. This is because blending family and financing can have potentially bad consequences. It puts your personal relationships and the financial future of your family and friends in the line. Every business has to pay federal income taxes on business income. How you pay those taxes and the tax rate you pay depends on your business structure.

Start your 3-day free trial today!

As you may have known, getting out of any tricky situation starts by recognizing the root cause of the problem. The same way, you don’t source for startup financing blindly. Therefore, before you even start to jot down the probable sources of funds, it’s paramount that you determine how much money you need. The figure will be shaped by numerous factors like your financial situation and the nature of business.

- Once again, if you’ve ever bought a car, qualifying for one of these loans will be familiar.

- The business plan doesn’t need to be a 20 to 30-page long detailed account of the market and the competition, what it does need to be is a financial forecast.

- These can include a product supplier, web developer, graphic designer, accountant, lawyer, financial advisor, tax professional, and many more.

- You’ll benefit even if you don’t have any employees, and when you are ready to hire, you’ll be able to offer them this benefit.

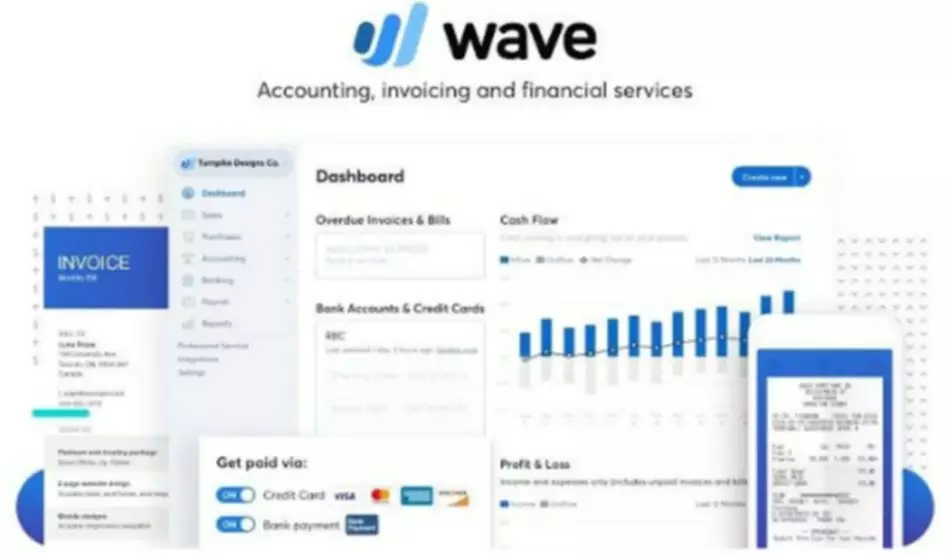

As such, when you are in a financial predicament, and no bank is willing to lend you, you don’t have to crumble to the pressure of the situation. Rather, you should seek alternatives ways to wade through the difficult and realize your business goal. One of the first financial decisions you need to make in your business is choosing between cash and accrual basis accounting. Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it. Grow Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it. California loans made pursuant to the California Financing Law, Division 9 of the Finance Code.

How FirstBlood’s switch to Ramp sped up their monthly close

This is yet another way of keeping your funding mission ultra simple. Secondly, if you own a large house, you can rent part of it to raise money for your business. Rental income may not be a quick fix, and it may not be a good option when you are at the seed stage. However, we consider this a safer bet than using your house as collateral to secure a loan. Most importantly, when your business reaches the growth stage, the rental income will be a steady source of funds to keep the business afloat.

Venture capital is money, technical, or managerial expertise provided by investors to startup firms with long-term growth potential. Companies seek equity financing from investors to finance short or long-term needs by selling an ownership stake in the form of shares. It is primarily a way to keep large purchases off a company’s balance sheet, making it look stronger and less debt-laden. The sponsoring company often overcapitalizes the SPV to make it look attractive should the SPV need a loan to service the debt. Mezzanine capital is treated as equity on the company’s balance sheet.

Business Credit Cards

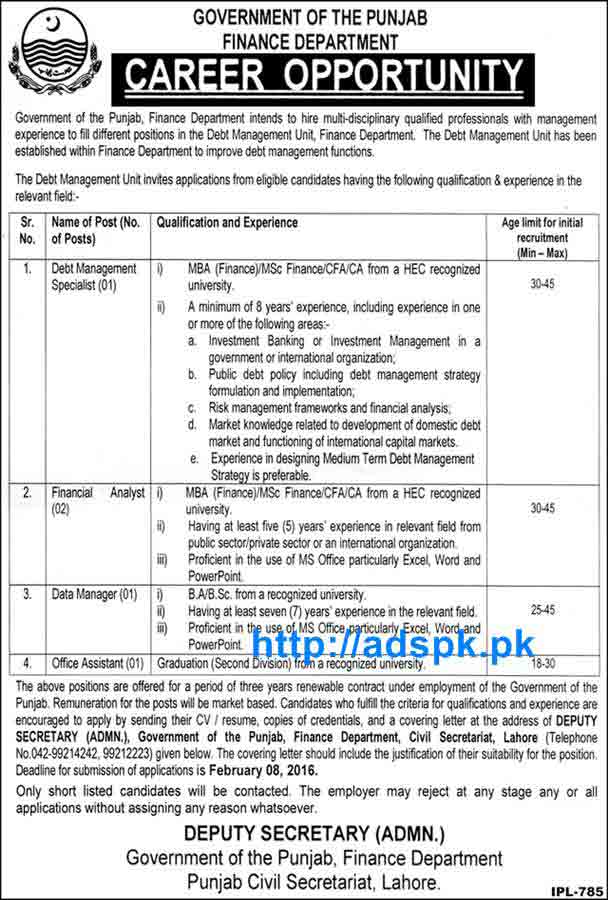

Hopefully, it’s served to give you a few helpful ideas and get your mind thinking about the possibilities. Do your research to find city, state, and industry-relevant grants for your small business. You can score an SVO grant for up to 45% of your gross-earned revenue (up to a maximum of $10 million). Remote work isn’t just a trendy millennial lifestyle choice anymore—now, businesses big and small across all industries have adopted remote work policies. The amount of wiggle room will vary from industry to industry and organization to organization, but the purpose is to make sure you’re getting the absolute best deal for your business.

However, many new small businesses may not meet their qualifications. Banks also offer credit cards, however the interest rates can be much higher and can increase to 18-29% if cardholders miss payments. Find the best source of funding for your business and your financial position. Debt and equity financing, crowdfunding, business loans, and business credit cards are other popular forms of small business financing.

Each round has a designated letter; the first round is called “Series A,” the second “Series B,” and so on. Most of the companies attracting venture capitalists are in tech, finance, or an industry that’s poised for tremendous and immediate growth. If you own a business that could potentially “disrupt” the market, you might be a good investment for one of these firms seeking equity in the brightest innovators. They want a piece of the pie, usually in the form of stock in the company. They may also want to give input on the business, offering ideas and expecting them to be implemented. If you sell products or a service to other businesses , you may allow them to pay at a future date.

In addition, organization is a major component of sound money management. Don’t be afraid to consult a professional, but make sure you have a handle on the day-to-day management of your business’s finances, as well as a plan for the future. Online loans vary in scope, price, and purpose, but it is assumed that they are more efficient and can produce a quicker turnaround from application to funding. Many can also provide you with a pre-approval— to let you know if you’ll have good chances of qualifying, your general loan amount, and the costs— before you ever apply. Because they are often more flexible, online loans will typically be more expensive than bank loans. If you need cash quickly, though, this is an important option to consider.

- If you don’t have an existing relationship with a large bank or one that offers business financing, you can search for local banks in your community.

- Tapping into your 401 is another interesting way of funding our startup.

- These are the most common of the SBA loans, offering qualified U.S. businesses low-interest loans for working capital through a variety of partner lending institutions.

- This is a last resort as it is an expensive and complex process requiring an experienced bankruptcy attorney.

If you’ve ever bought a home, you already know the basics of commercial straight line depreciation loans. Like any property financing, they can include a myriad of costs, from the price of the building or property itself to closing costs, fees, surveys, inspections, taxes, and title insurance. Commercial real estate loans can be enormous (often referred to as “jumbo” loans) but due to collateral, interest rates can be attractive. These are the most common of the SBA loans, offering qualified U.S. businesses low-interest loans for working capital through a variety of partner lending institutions.

Commercial Real Estate Loans

Sometimes the money just isn’t flowing in fast enough due to a client or two (or more!) not paying on time. Your contracts may include provisions regarding customers’ right to lower payments as a result of reduced revenue or to cease payments during a health-related shutdown. Under the FTC Act, you have a legal obligation to honor your representations. Find legal resources and guidance to understand your business responsibilities and comply with the law.

The 8 best options for small business funding – CNBC

The 8 best options for small business funding.

Posted: Fri, 22 Jul 2022 07:00:00 GMT [source]

Boosting revenue and cutting costs won’t amount to much if you don’t know where the money is going. Into law that moved the application deadline from March 31, 2021 to May 31, 2021. However, funding is still on a first-come, first-served basis—apply ASAP because funds may run out. See funding solutions from 75+ nationwide lenders with a single application.

Share your predicament and see if they can work with you to lower interest rates, increase your credit line or restructure repayment options. You can also try outsourcing to a debt relief company that can negotiate on your behalf to settle debts for lower rates. As a last resort, consider invoking the concept of force majeure, especially if the pandemic has hit your company hard. While borrowing makes sense when cash flow is low or a business is in a period of growth or expansion, too much debt can end up being a heavy burden.

Types of bad credit business loans – Bankrate.com

Types of bad credit business loans.

Posted: Fri, 24 Feb 2023 08:00:00 GMT [source]

If a startup business is not eligible for a traditional bank loan or an SBA 7 loan, which can often be the case, it may be eligible for an SBA microloan. The advantage of financing your startup business with the help of family and friends is that you can often get fairly lenient repayment terms. You have to consider that they might want a stake in your firm if you are agreeable. Avoid borrowing money from your personal funds above your original investment. And be careful before taking out a business loan to keep your company afloat. Indeed, some state courts currently prohibit you from filing collection actions or invoking confessions of judgment.

Where To Find Business Grants – Bankrate.com

Where To Find Business Grants.

Posted: Tue, 24 Jan 2023 08:00:00 GMT [source]

For even more accelerated growth, you might seek venture capital. With the same benefits as an angel investor , these firms can take your business from idea to market in exchange for shared ownership. These firms invest in phases, or “rounds,” putting hundreds of thousands, or even millions, into a company they believe has the potential to make them a lot of money.